Dissomaster is a program that calculates TEMPORARY guideline child and spousal support.

- The DissoMaster™ program was designed by attorneys to follow the guidelines set out in the California Family Law Code. We always use the most current version of the DissoMaster™ available so you know that you are getting the correct support amount.

- DissoMaster calculates complex family law formulas For more than 20 years, DissoMaster software has helped family law professionals with calculating complex formulas. Its goal is to reduce the time it takes for you to extract accurate numbers from the raw data of each case.

- . The DissoMaster™ TimeShare™ Microsoft Excel™ spreadsheet has been included. Version 2003-1a. When working on a file saved with a previous version of DissoMaster, the FileSave and FileSave As features sometimes failed with a message similar to “DissoMaster cannot save file”. This has been fixed.

- DissoMaster™ Suite is the premium software bundle for computing support calculations under the California Statewide Uniform Child Support Guidelines. This software combines the most relevant tools for the family law practitioner or court in one simple-to-use suite of calculators. Just fill in the fields and let the calculators do the work.

Dissomaster Testimonials & Endorsements “When I first called this law office and set up my initial consultation with Michael Peterson for my pending divorce, I was impressed with how professional and straight-to-the-point he was.

Temporary Spousal SupportThe support that you're ordered to pay from the time you file for divorce until your divorce is final (a minimum of 6 months in California) is considered “temporary” support. Temporary support is usually set at a higher rate than permanent support.

In re the Marriage of ANDREA L. and MICHAEL P. SCHULZE, No. G015895, COURT OF APPEAL OF CALIFORNIA, FOURTH APPELLATE DISTRICT, DIVISION THREE, 60 Cal. App. 4th 519; 70 Cal. Rptr. 2d 488; December 29, 1997, Decided: “Temporary support … usually is higher than permanent support because it is intended to maintain the status quo prior to the divorce.”

By the time my husband’s divorce was final, he'd paid at the higher “temporary” rate for more than 2 years (versus the 6-month period that it's intended to cover).

Dissomaster v. Permanent Support

Permanent spousal support is NOT supposed to be based on Dissomaster; it's supposed to be calculated by the Judge...and the Judge is NOT supposed to use Dissomaster as a guide.

In re the Marriage of ANDREA L. and MICHAEL P. SCHULZE, No. G015895, COURT OF APPEAL OF CALIFORNIA, FOURTH APPELLATE DISTRICT, DIVISION THREE, 60 Cal. App. 4th 519; 70 Cal. Rptr. 2d 488; December 29, 1997, Decided: “The spousal support component of a permanent family support order must be based on the statutory factors enumerated in section 4320 of the Family Code, not pegged to a number generated by a computer program intended for use in calculating temporary support [DissoMaster].”

But be prepared: Even though--BY LAW--spousal support is NOT supposed to be based on Dissomaster, IT IS! It

But be prepared: Even though--BY LAW--spousal support is NOT supposed to be based on Dissomaster, IT IS! It Child Support California Calculator

ALWAYS is!My husband's permanent spousal support was also based on Dissomaster. When specifically questioned about this, his attorney chose to avoid the question rather than answer it. Attorneys don't want to argue this point with the judge. In fact, they're probably counting on the fact that you don't know this law.

You CAN fight this...but you'd better make sure that it will be worth the potentially enormous attorney fees that you're likely to incur, because you’ll probably have to take your case all the way to the Calfornia Court of Appeals. Then again, if you were (un)lucky enough to be married for 10+ years, it may be worth your while to fight this if you're looking at paying a large amount of spousal support for the rest of your ex's life!

Dissomaster Manual

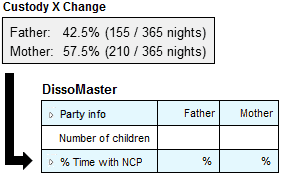

When entering the Health Insurance deduction in DissoMaster,* be sure to drill down. There are three options and they make a difference: “paid by party”, “pre-tax wage deduction” or “wage deduction.” Getting it wrong can make a significant difference in the calculation.

Paid By Party

“Paid By Party” is for premiums paid by the party directly to the insurer after the Premium Tax Credit (PTC). This includes the advance PTC. Typically, this is used for self-employed individuals who pay their premiums directly to the insurer. Per the DissoMaster user manual, “[t]his is an income adjustment or an itemized deduction and a guideline deduction.”

Pre-tax Wage Deduction

Dissomaster Cflr

“Pre-tax Wage Deduction” is for an employee’s health insurance contributions that are deducted pre-tax from the paycheck by the employer. This number affects the calculation for adjusted gross income and is also a guideline deduction for child support.

Wage Deduction

“Wage Deduction” is for entering the portion of the health insurance costs that is withheld from a paycheck on an after-tax basis or amounts paid directly to the insurer by a salaried employee. The software then treats the entire amount here as an itemized medical deduction, which would be on Schedule A.

Screenshot from the DissoMaster software showing the Health Insurance data entry

See the DissoMaster user manual under “Health Insurance” for more explanation.

So don’t be a DissoMaster dunce!

If you get it wrong, it can make a big difference in the support calculation. Make sure you are entering the health insurance payments correctly to ensure that you get the calculation right!

Child Support Calculator

*DissoMaster is a trademark of The Rutter Group, a Thomson Reuters business. To purchase DissoMaster call The Rutter Group at (800) 747-3161 ext. 2 or visit CFLR for more information.